Property and capital gains tax. Depreciation is an income tax.

A Step By Step Guide To Land Title Transferring In The Philippines Infographic Myproperty Ph Title Philippines Infographic

Three ways to avoid.

. Although it is referred to as capital gains tax it. Dont forget your state may have its own tax on income from capital gains. And very high-income taxpayers may pay a higher effective tax rate because.

Keeping records for property. Plus pest and building inspections stamp duty and solicitors fees on the purchase of the property. Property Tax Rules Published as of September 2017.

Avoid Capital Gains Tax on Real Estate in 2022. Only incomes of 9950 or less are taxed at the 10 bracket as of 2021. This includes rental properties holiday houses hobby farms vacant land and business premises.

They range from 10 to 37 for the 2021 tax year the return youll file in 2022. Use our calculator or steps to calculate your CGT. Most property except your main residence home is subject to capital gains tax.

Calculator How Property Tax Works. Your main residence home. If you live in the property right after acquiring it the asset can be listed as your Primary Place Of Residence PPORThat makes it exempt from CGT.

Avoiding capital gains tax on a rental or additional property If you own an additional property that you plan to sell you will need to plan ahead to lower your tax liability. Thats a significant 7 difference. Residential real estate can be depreciated over 27 ½ years or 40 years depending on the schedule you adopt.

The property is debt free. Providing the Guidelines in Determining Whether a Particular Real Property is a Capital Asset or an Ordinary Asset Pursuant to Section 39A1 of the National Internal Revenue Code of 1997 for Purposes. REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU OF INTERNAL REVENUE Quezon City December 27 2002.

Long-term gains are more advantageous than short-term gains tax-wise. Source capital gains. Property tax is a tax assessed on real estate.

The property has been held for more than one year and has appreciated significantly. Plus real estate agent fees and solicitors fees on the sale of the property. The tax is usually based on the value of the property including the land you own and is.

In addition it makes sense to donate real estate where. Chapter 12D-1 1 CHAPTER 12D-1 GENERAL RULES 12D-1002 Definitions 12D-1003 Situs of Personal Property for Assessment Purposes. Youd pay a 15 long-term capital gains tax but youd pay 22 for every dollar in the 22 tax bracket if the gain were short-term and you were taxed according to your tax bracket.

Preform studies reports analysis memoranda and other similar documents. How to avoid capital gains tax in Australia 1. Property investors can save thousands of dollars by simply understanding the capital gains tax property 6-year rule.

If there is debt on the property you may be subject to IRS bargain sale rules which can generate some capital gains tax and lower the value of your charitable deduction. According to the Housing Assistance Tax Act of 2008 a rental property converted to a primary residence can only have the capital gains exclusion during the term in which the property was used as. Suppose youre single and earn 80000 in tax year 2021.

A capital gain is only possible when the selling price of the asset is greater than the original purchase price. Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. Take advantage of being an owner-occupier.

You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Here are ways to avoid or minimize capital gains tax on a home sale. 46112 Foreign Investment in Real Property Tax Act 461121 Program Scope and Objectives 4611211 Background 4611212 Skip to main content.

The owner of real property who also owns mineral oil gas or other. IR-2018-227 November 19 2018 WASHINGTON The Internal Revenue Service today reminded taxpayers that like-kind exchange tax treatment is now generally limited to exchanges of real property. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

Ordinary gains are taxed just like regular income so the tax brackets are the same. An asset may include tangible property a car a business or intangible property such as shares. This increases to 19900 for married couples who file joint returns.

Nonresident aliens are generally not subject to tax on US. Local governments typically assess. Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property.

The Tax Cuts and Jobs Act passed in December 2017 made tax law changes that will affect virtually every business and individual in 2018 and the years.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What Is It When Do You Pay It

How Does The Lifetime Capital Gains Exemption Work Capital Gain Capital Gains Tax Tax Help

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Nyc 1031 Exchange Rules In Nyc Hauseit Real Estate Terms Investing Capital Gains Tax

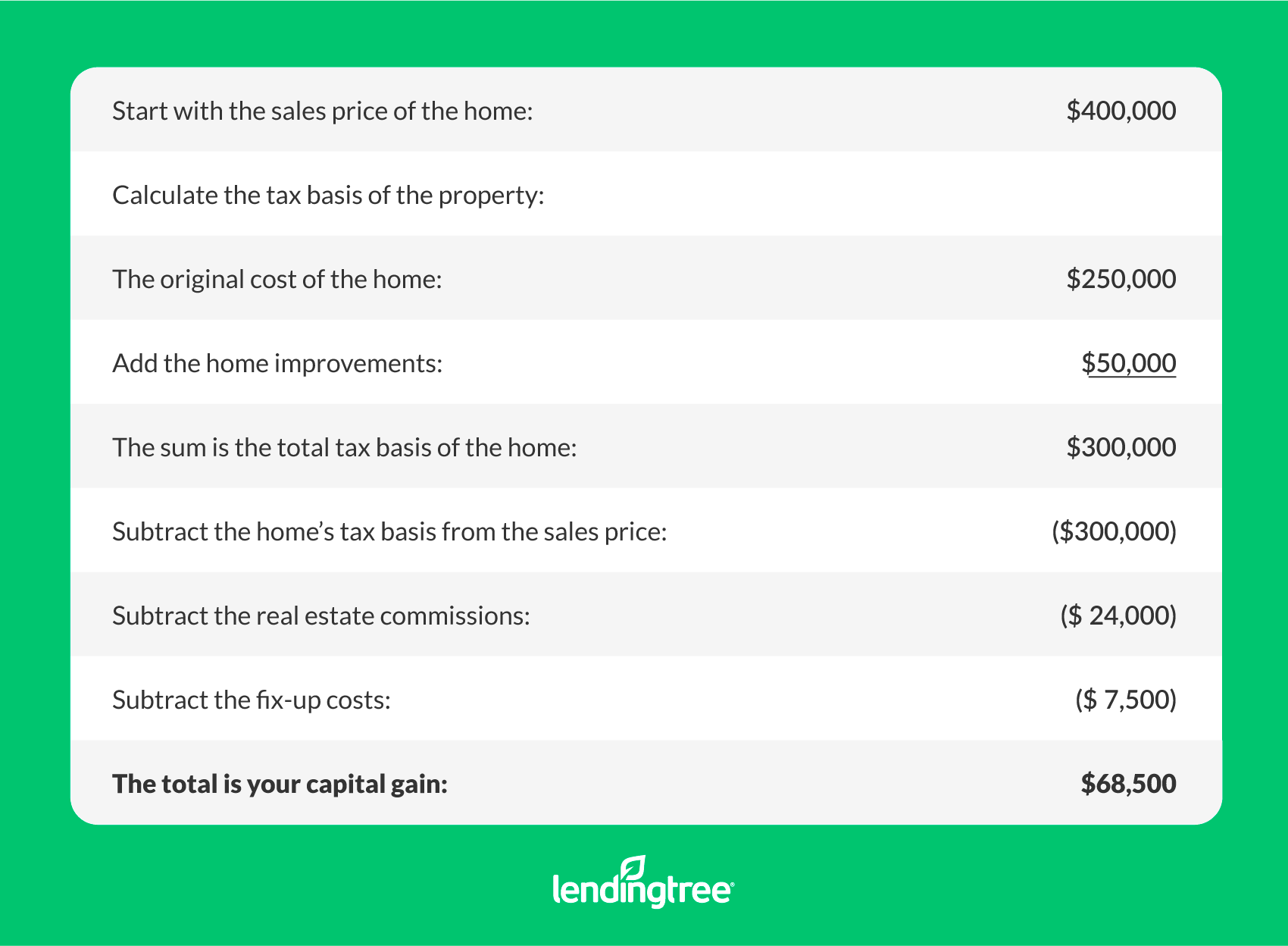

Capital Gains Tax On A Home Sale Lendingtree

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Pin By Andrea Bunch On Moving Abroad Budget Planning Estate Tax Buying Property

Capital Gains Tax On Real Estate And Selling Your Home In 2021 Bankrate Capital Gains Tax Capital Gain Bankrate Com

Do You Pay Capital Gains Taxes On Property You Inherit You Are Not Able To Take The Exclusion But You Might Benefit From T Capital Gains Tax Capital Gain Tax

Florida Real Estate Taxes What You Need To Know

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate

Like Kind Exchanges Of Real Property Journal Of Accountancy

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)